New residential, commercial buildings start construction regionwide with firm’s latest capital raise

A multifaceted development in south-central Sioux Falls, major investments in booming Harrisburg and an expansion of a popular southwest Sioux Falls apartment community. They’re all projects being funded with support from equity raised by Ernst Capital Group, which partnered with developer Clint Ackerman, owner of Signature Cos., to support several of his current projects. “They didn’t have much time to raise the funds we needed, and it went very well,” said Ackerman, who previously has worked with Ernst in financing his developments. “As always, they are the most professional equity group out there. We have a great long-lasting relationship, and I look forward to continuing it.” The projects within Signature Fund IV represent what was, until just recently, Ernst’s largest fund, with just under $22 million in capital raised. “It was committed very quickly,” partner Chris Daugaard said. “The momentum of the region is continuing to propel interest in being part of these projects. And with our model, we can plan the fund, structure and size it around what the developer is looking to do and create a unified team and plan.” Here’s a closer look at the projects under construction thanks to this partnership.

Stadium Commons

It’s rare – and soon nearly unheard of – to find nearly 20 undeveloped acres in the heart of south Sioux Falls, but that’s what Signature was able to acquire on the northeast corner of 69th Street and Cliff Avenue. “Our plan is to put 10 acres of multifamily in the back and use the remaining portion for commercial,” Ackerman said. “We held off on foundations until spring, but now we’re going full force.” The first 258-unit apartment building will include an attached two-story clubhouse and full slate of amenities, including a swimming pool, extensive indoor-outdoor community space and a fitness center. The plan is to open the first apartments in 2023. On the commercial side, “we have half of the eight lots under contract and are working on the fifth,” Ackerman said. “It’s a combination of retail centers and stand-alone users, and we’ve been happy with the level of interest we’ve received.” From Ernst’s perspective, “this is a valuable opportunity for development,” Daugaard said. “It’s such a prominent intersection; it’s appealing for multiple uses. That’s one of the strengths of the Signature team is the ability to acquire these larger tracts of land and do a multitude of uses, including residential and commercial. And bringing more residents to the immediate area supports and attracts additional retail and services.”

It’s rare – and soon nearly unheard of – to find nearly 20 undeveloped acres in the heart of south Sioux Falls, but that’s what Signature was able to acquire on the northeast corner of 69th Street and Cliff Avenue. “Our plan is to put 10 acres of multifamily in the back and use the remaining portion for commercial,” Ackerman said. “We held off on foundations until spring, but now we’re going full force.” The first 258-unit apartment building will include an attached two-story clubhouse and full slate of amenities, including a swimming pool, extensive indoor-outdoor community space and a fitness center. The plan is to open the first apartments in 2023. On the commercial side, “we have half of the eight lots under contract and are working on the fifth,” Ackerman said. “It’s a combination of retail centers and stand-alone users, and we’ve been happy with the level of interest we’ve received.” From Ernst’s perspective, “this is a valuable opportunity for development,” Daugaard said. “It’s such a prominent intersection; it’s appealing for multiple uses. That’s one of the strengths of the Signature team is the ability to acquire these larger tracts of land and do a multitude of uses, including residential and commercial. And bringing more residents to the immediate area supports and attracts additional retail and services.”

Creekside Commons, Creekside Plaza 2

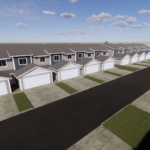

The community of Harrisburg is showing every day that it can support more residential and commercial activity – so Signature is building on the success of its Creekside development with more retail and living opportunities. Creekside Commons, a 168-unit town home community, is about one-third constructed and is expected to take about 18 more months to complete. “Everything in that area is complementary,” Daugaard said. “There’s commercial across the street, which brings more traffic, a new day care, and the adjacency to the main commuter traffic in and out of town and around the school just continues to be where people want to locate.”

The community of Harrisburg is showing every day that it can support more residential and commercial activity – so Signature is building on the success of its Creekside development with more retail and living opportunities. Creekside Commons, a 168-unit town home community, is about one-third constructed and is expected to take about 18 more months to complete. “Everything in that area is complementary,” Daugaard said. “There’s commercial across the street, which brings more traffic, a new day care, and the adjacency to the main commuter traffic in and out of town and around the school just continues to be where people want to locate.”

Creekside Plaza 2, a new 9,200-square-foot retail center, also is included in Signature Fund IV and will mirror its predecessor, which was part of a previous fund. “The original retail center has been fully leased since the day we got it completed, and we’ve started to sign up the first tenants at Plaza 2,” Ackerman said. “We expect it will be 50 percent full in the next two weeks to 30 days.” He anticipates the retail building will be done with its exterior and shell in 60 days, so tenants can begin opening by fall. “When we funded Creekside 1, it was a bit unique for us as a spec retail and office building, but it filled so quickly and ahead of expectations it gave us confidence there would be more demand,” Daugaard said. “All the housing next door is going to support that – and you can’t beat being right next to a B&G Milkyway.”

85 Commons

The success of Signature Cos.’ West Pointe Commons development in southwest Sioux Falls has led to a second phase. This one is called 85 Commons for its location at 85th Street and Townsley Avenue. The 55-unit building is about 60 percent complete and should be ready in the next six months, Ackerman said. “West Point Commons was essentially full for the last four years, so we know we need additional capacity in that area,” he said. 85 Commons will offer a mix of one-, two- and three-bedroom units with attached garages and a choice of floor plans and unit features. “Southwest Sioux Falls is in high demand as a place to live, so we’re excited to help offer more options,” Daugaard said. “This is just blocks from Harrisburg Explorer Elementary and Platinum Valley Park, and we know it will appeal to a broad range of residents.”

The success of Signature Cos.’ West Pointe Commons development in southwest Sioux Falls has led to a second phase. This one is called 85 Commons for its location at 85th Street and Townsley Avenue. The 55-unit building is about 60 percent complete and should be ready in the next six months, Ackerman said. “West Point Commons was essentially full for the last four years, so we know we need additional capacity in that area,” he said. 85 Commons will offer a mix of one-, two- and three-bedroom units with attached garages and a choice of floor plans and unit features. “Southwest Sioux Falls is in high demand as a place to live, so we’re excited to help offer more options,” Daugaard said. “This is just blocks from Harrisburg Explorer Elementary and Platinum Valley Park, and we know it will appeal to a broad range of residents.”

Prairie Village Commons

Signature Cos. also is expanding in the Des Moines market, and the latest fund with Ernst supports that growth as well. The company’s Prairie Village Commons will be 127 town home-style units in the western suburb of Waukee. A groundbreaking is scheduled soon and construction is expected to last two years. “The Des Moines market is a larger metro than Sioux Falls, but the two operate similarly,” Ackerman said. “Waukee was ranked one of the fastest-growing communities in the nation, and we’re fortunate we got there a few years ago.” The market also is one Ernst views favorably. “The fundamentals of Des Moines and Sioux Falls are very similar,” Daugaard said. “So when we can invest in a known market with a known developer, we consider that a favorable opportunity.”

Ernst Capital is pleased to report that the Signature Real Estate Income Fund II, LLC (“Signature Fund II”) has closed on its sale of the Avera building on Cliff Ave located in Sioux Falls, SD. The transaction was finalized on April 14th, 2022, as a local investor purchased the property via 1031 exchange.

Ernst Capital is pleased to report that the Signature Real Estate Income Fund II, LLC (“Signature Fund II”) has closed on its sale of the Avera building on Cliff Ave located in Sioux Falls, SD. The transaction was finalized on April 14th, 2022, as a local investor purchased the property via 1031 exchange. Ernst Capital is pleased to report that the Dakotas Real Estate Income Fund IV, LLC (“Dakotas Fund IV”) has closed on its sale of the Park88 Apartments property (“Park88”) located in West Des Moines, IA. The transaction was finalized on February 23rd, 2022, as an out-of-state investment firm purchased the property.

Ernst Capital is pleased to report that the Dakotas Real Estate Income Fund IV, LLC (“Dakotas Fund IV”) has closed on its sale of the Park88 Apartments property (“Park88”) located in West Des Moines, IA. The transaction was finalized on February 23rd, 2022, as an out-of-state investment firm purchased the property. Every deal Ernst Capital Group makes passes across his desk. And in the near decade Nick Gates has been with the firm, that’s a lot of deals. “The first opportunity I had was Ernst Capital,” said Gates, who joined the team in 2012. “I started here, and I’m still working to help us and our investors find the next good investment.” Gates was one of the firm’s first employees, and his career has grown with Ernst Capital. A native of Mitchell, he went to Dakota Wesleyan University with majors in mathematics and business. The latter led him to earn his MBA at USD immediately after graduation. “I graduated from DWU in 2010 when it was a tough time for business coming out of the Great Recession,” Gates said. “So I went and finished my MBA and applied for a host of jobs after that.”

Every deal Ernst Capital Group makes passes across his desk. And in the near decade Nick Gates has been with the firm, that’s a lot of deals. “The first opportunity I had was Ernst Capital,” said Gates, who joined the team in 2012. “I started here, and I’m still working to help us and our investors find the next good investment.” Gates was one of the firm’s first employees, and his career has grown with Ernst Capital. A native of Mitchell, he went to Dakota Wesleyan University with majors in mathematics and business. The latter led him to earn his MBA at USD immediately after graduation. “I graduated from DWU in 2010 when it was a tough time for business coming out of the Great Recession,” Gates said. “So I went and finished my MBA and applied for a host of jobs after that.” Queen City Balloon Bar is opening a storefront location on the east side of Sioux Falls. Ryan Egan and his wife, Christine, have been running the balloon bouquet business for years out of their home. “We do upscale balloon decorations and gifts,” he said. “It’s more of a boutique than going into a party store and doing something quick”, according to Ryan. The store’s hours will vary Tuesday through Saturday.

Queen City Balloon Bar is opening a storefront location on the east side of Sioux Falls. Ryan Egan and his wife, Christine, have been running the balloon bouquet business for years out of their home. “We do upscale balloon decorations and gifts,” he said. “It’s more of a boutique than going into a party store and doing something quick”, according to Ryan. The store’s hours will vary Tuesday through Saturday.  A record building year in Sioux Falls and similarly strong activity regionwide is driving significant interest in real estate investing. Whether you’re currently invested in local real estate or considering it, knowing market conditions and potential challenges is key to understanding your opportunity. We sat down with Chris Daugaard, a partner in Ernst Capital Group, for insight on the market today and looking ahead.

A record building year in Sioux Falls and similarly strong activity regionwide is driving significant interest in real estate investing. Whether you’re currently invested in local real estate or considering it, knowing market conditions and potential challenges is key to understanding your opportunity. We sat down with Chris Daugaard, a partner in Ernst Capital Group, for insight on the market today and looking ahead.  Real estate investing can be a complicated topic, especially for the uninitiated. Explaining it is what keeps Chris Daugaard excited about his role. “What I really like about working with investors is taking what can be a complex or uncommon topic like development or finance and trying to describe it to people who don’t do this as a day-to-day job,” said Daugaard, a partner in Ernst Capital Group. “I don’t come from a real estate background. I’m not a deep finance guy. So it’s fun for me to explain things how I relate them and have people get as excited about our projects as I do.”

Real estate investing can be a complicated topic, especially for the uninitiated. Explaining it is what keeps Chris Daugaard excited about his role. “What I really like about working with investors is taking what can be a complex or uncommon topic like development or finance and trying to describe it to people who don’t do this as a day-to-day job,” said Daugaard, a partner in Ernst Capital Group. “I don’t come from a real estate background. I’m not a deep finance guy. So it’s fun for me to explain things how I relate them and have people get as excited about our projects as I do.” According to a recently published article, many Sioux Falls area property management companies are seeing historical highs in occupancy and leasing of rental properties. Many Sioux Falls properties are anywhere from 99 to 100 percent leased. “Anything that is coming vacant is almost already spoken for even before it becomes vacant,” according to the article.

According to a recently published article, many Sioux Falls area property management companies are seeing historical highs in occupancy and leasing of rental properties. Many Sioux Falls properties are anywhere from 99 to 100 percent leased. “Anything that is coming vacant is almost already spoken for even before it becomes vacant,” according to the article.  LINC at Gray’s Station has filled yet another one of the building’s commercial spaces with a high-end nail salon, Tipsy Nails. According to the article, “

LINC at Gray’s Station has filled yet another one of the building’s commercial spaces with a high-end nail salon, Tipsy Nails. According to the article, “ LINC at Gray’s Station has announced a new tenant in one of the building’s ground-floor commercial spaces. According to the article, “Iowa Spine and Performance will open in a retail bay at LINC, 210 Southwest 11th St. It is the third business announced for the commercial ground floor of LINC, which fronts Martin Luther King Jr. Boulevard. Also planned is

LINC at Gray’s Station has announced a new tenant in one of the building’s ground-floor commercial spaces. According to the article, “Iowa Spine and Performance will open in a retail bay at LINC, 210 Southwest 11th St. It is the third business announced for the commercial ground floor of LINC, which fronts Martin Luther King Jr. Boulevard. Also planned is